I made my first ever “investment” in mutual funds more than two decades ago and I didn’t know anything about mutual funds then. My father was dead against it – he called it no different from betting on a horse race. But a friend of mine had highly recommended a friend of his – as person I can trust “to not run away with my money” – who will help me do so. The process of investing was tedious with all kinds of forms to be signed in 6 six different places and true copies of various documents to be submitted each time I had some small surplus in my savings account to invest. This friend’s value addition was – He managed all this tedium, he gave me these colorful brochures to read without which I wouldn’t have known where my money was going, he sent me an account statement every month (which he prepared by hand).

During the last decade or so, technology has changed this process completely. I don’t need this friend of friend anymore to do all the things he was doing for me then. Every AMC now has an app or a technology platform using which I can do all this myself. There are at least 20 or 30 independent apps and/or technology platforms which claim to be AMC agnostic. Technology claims to have gone even further, way beyond whatever my friend was able to do for me – Use knowledge of financial markets in ways my friend could never have used – because it was either not available to him and/or it was too voluminous for any human being to digest and distill down to specific action, Perform complex computations such as the Efficient Frontier : the optimal balance between risk and rewards or solve Black-Scholes equation, which my friend could never have been able to do.

It is therefore claimed that technology today can deliver a level of productivity even when I do everything on my own, which in the old days I could never have got even with the help of a specialist like my friend. But let’s examine that claim a little more closely.

Technology has enabled the distillation of ALL the “extrinsic” factors which can influence investment decisions – financial markets, products, assets, events which affect all these and so on, to deliver digestible capsules of information – information which in the old days was very hard to get. One could therefore argue that technology has enabled making far more informed and “rational” decisions. “More informed” and to the extent that availability of better information facilitates taking “better” decisions, certainly. However “Rationality” is not a function of the amount or quality of information. Rationality is the result of being able to overcome our emotions and impulses.

Emotions and impulses are the “intrinsic” factors which influence investment (or for that matter, ALL) decisions – fear, greed, faith and so on. Does (and if at all) technology help us curb and control these? Could availability of timely and better quality information help address our fear of the unknown? Could it help us overcome our greed by informing us about the consequences of greed seen in the past?

However, countless studies have shown that we don’t actually use information objectively. We ignore information which goes counter to our beliefs, we draw only those inferences from it which reinforce our biases. So while technology helps us execute our decisions orders of magnitude more efficiently – faster and cheaper, it does not necessarily enable us to make “better” and “more rational” decisions by simply providing us more and better information about all the “extrinsic” factors which are important in making decisions. This information is important but not sufficient. We need somebody or something to hold a mirror in front of us to inform us about our own “intrinsic” attributes, analyze our own behavior and highlight how our impulses could lead us away from reason.

That is something, at least I have not seen any app or investment platform built using the fanciest imaginable technology, be able to do thus far.

But could it do so in the future?

Could technology be built in the future that can analyze our own past behavior and distilling up knowledge about our “intrinsic” biases and beliefs and how they affect our decisions? What would it take to build such technology? That is a subject for a “white-paper” in itself but briefly –

First, we will need a model of our behavior – specifically behavior which we display while making financial decisions. Attempts to do so have been made in the past e.g. Kahneman and Tversky’s Prospect Theory is one such example. Second, we need data about our past (financial) behavior to create a faithful simulation of such a model (in currently fashionable terminology, this would be called machine learning). This – the gathering of this data is no mean task but if it can be done, perhaps technology is reaching a stage where building models of sufficient fidelity may be possible.

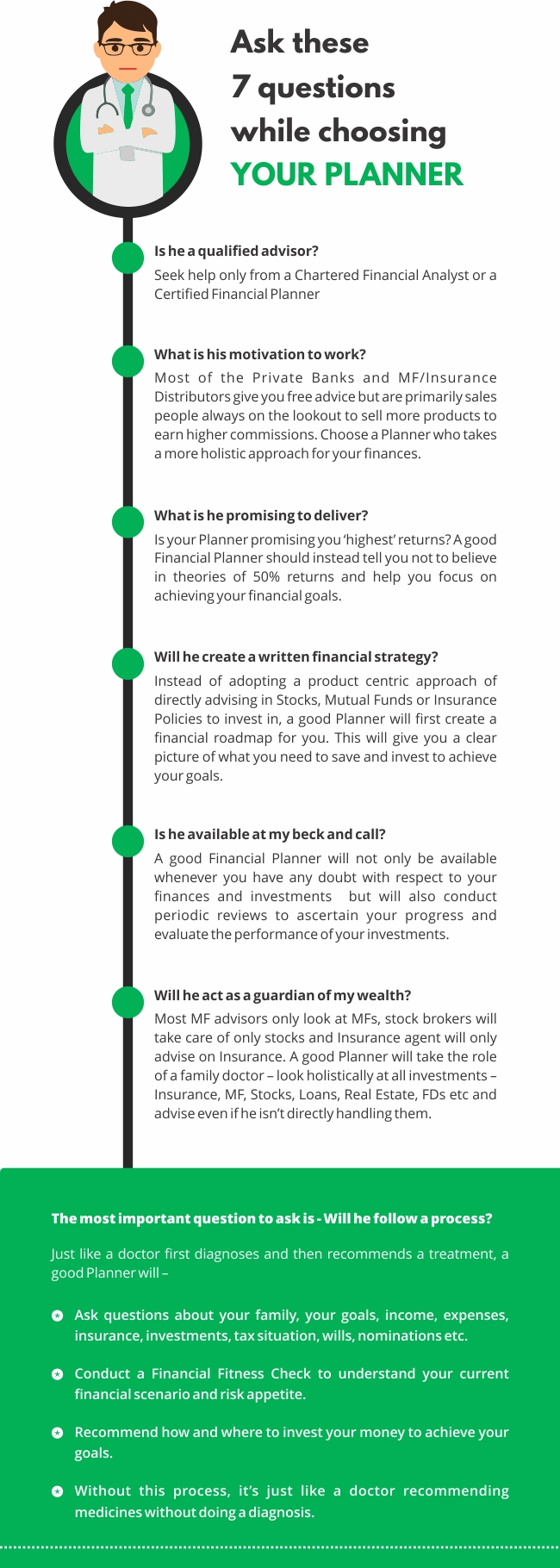

But until then to hold the mirror in front of us to let us see for ourselves the irrational influence of our intrinsic emotions and impulses, we better find an advisor with the right expertise and whom we trust.