Culturally, Indians are entrenched in family values and it doesn’t come as much of a surprise that securing one’s children’s future sits at the top of most parent’s priority list. Making sure that the coming generation has a superior quality of life and better opportunities is what all parents want. In today’s article, I’ve answered some of the most common questions parents have while planning for their child’s future.

- What are the biggest investing mistakes people make while saving for their children?

Most parents opt for Children’s insurance plans and feel they have secured their child’s future. A children’s insurance plan is a very inefficient way of saving money for your child’s future. In fact, setting aside money for your child’s goals like education, and marriage can be achieved by investing in Mutual Funds or any other investment avenues.

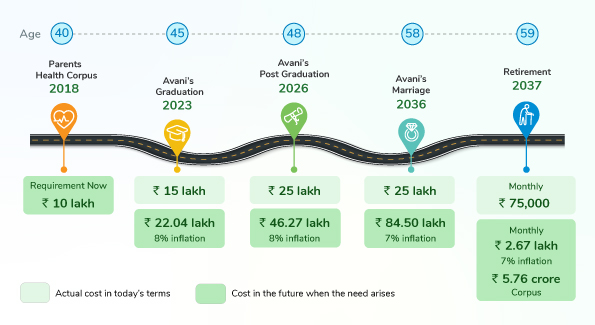

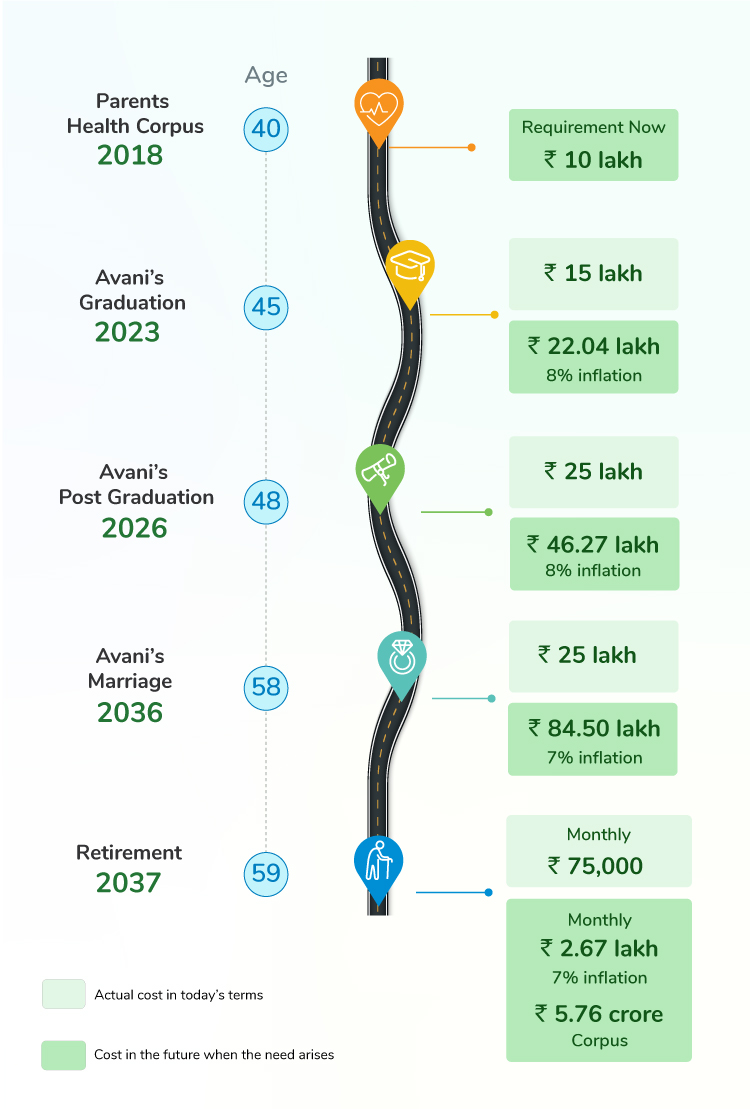

Another mistake parents make is to start planning for the child’s higher education only when the child has already neared the age of starting college. By then it is already too late to start building a corpus for higher education and they start eating into their retirement corpus. One of the biggest mistakes parents make is not ascertaining how much money they would need for their children’s goals. They tend to overlook the impact of inflation and how it will increase the financial requirements for their child’s education and marriage.

- Should one only look at long-term goals like education and wedding, or also save/invest for short-term goals?

While higher education and marriages are big expenses in the long run, there are many expenses that come up in the short term. School fees and other extra-curricular expenses have skyrocketed. These recurring costs may not look big taken alone, but over a period they will significantly impact your family’s budget.

Be it your child’s school fees, higher education, or marriage, prepare an estimate of how much you would require for each goal and when you require it. Start saving and investing towards these goals through monthly SIPs from the time of the child’s birth.

- What kind of mutual fund should one invest in for a child’s goals?

The first step would be to ascertain the major milestones you want to plan for – graduation, post-graduation, marriage, etc. All of these require a lot of money and you will greatly benefit if you start investing for these milestones well in advance. If you start investing a small amount from the time your child is born, you will have considerable time to build a good corpus for your child’s education and marriage.

For long-term goals (more than 5 years away) you should invest your money in Equity Mutual Funds which will help your money grow and achieve these goals. Expenses that you will incur for your child within 3 to 5 years, like your child’s schooling, can be invested in debt and balanced Mutual Funds. When it comes to short-term goals, there isn’t a lot of time for your investments to grow as you may need the money in 1 to 2 years. For such goals, it is advisable to keep your money in a Liquid, Arbitrage Fund.

However, there is a pressing need to gain a holistic view of one’s overall situation prior to creating any plan. The best thing to do is to get in touch with a financial coach to help you streamline your finances in a way that helps you achieve your goals.

- Should one invest in real estate for the kid’s life goals?

For most people in India, buying real estate is not just an investment, but a dream goal. While we feel we own a physical asset that we can pass on to our children or sell to fund our children’s education or marriages, the truth is that real estate is not such a lucrative option anymore.

Real estate had a great run from the 1990s to 2008, and most people who talk about real estate giving great returns, are talking about their experience during this phase. However, post-2008 the real estate market has performed abysmally. The equity markets have outperformed the real estate markets by a great margin from 2009 to 2016 when it comes to capital appreciation.

Therefore, though people view real estate as a source of wealth creation and value appreciation, in reality, the picture is very different. So as an investor, it is better to invest in Mutual Funds than real estate. Mutual Funds are a much more liquid asset. It is not easy to sell real estate when the need arises.

Buy property for residential purposes rather than investment. DO NOT go overboard buying 2 or more properties thinking about retirement or kid’s needs or wealth creation. Look at building a more liquid, tax-efficient investment portfolio with mutual funds.

- Should one opt for Child Plans (ULIPs) or Endowment Plans?

People are made to believe that any product that is labeled as “Children’s Plan” is the best option for their children. But as parents, you must not fall for child-specific insurance products and “Children’s Plans”. Keep your insurance and investment decisions separate. The plan should be to cover risk through pure insurance products like Term Plans and opt for mutual funds for the purpose of investment.

The most important thing for a parent is to plan for your children’s goals and start investing in them in a consistent manner. This will help you realize the bright future you envision for him/her and safeguard your family’s financial future.