“The importance of money flows from it being a link between the present and the future.”- John Maynard Keynes

With the amount of time people spend thinking about making more money in the present, it is quite surprising that planning one’s finances and maximizing them the right way for the future falls low on the priority list. People would have a financial masterpiece on their hands if only they spent more time on planning and allocating available funds in a systematic way as opposed to spending time and effort on accumulating money in the first place.

People often procrastinate when it comes to planning their finances. ‘I’m still too young to do this’, “The time isn’t right”, and “The market isn’t in the best shape right now”; are very common laments by people who stall their financial coaching process. But while chasing perfection is good, wasting precious investment time while pursuing it is a foolhardy thing to do.

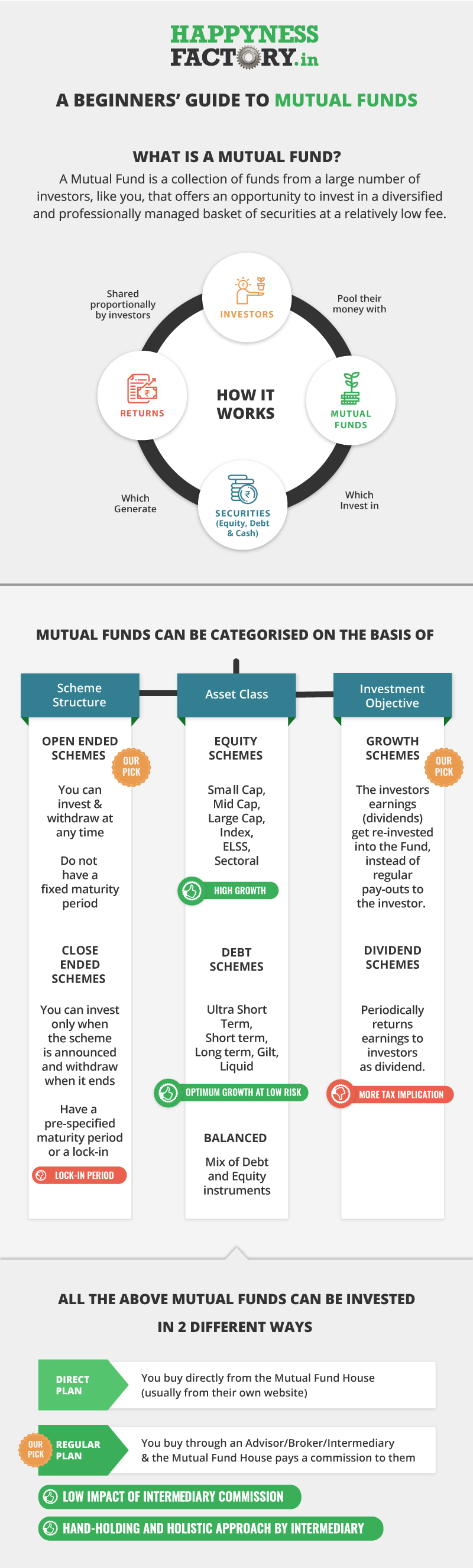

Like with any other venture, the beginning is the hardest part. The right time to start, the tools needed for success, and how to get ahead are only a FEW questions that arise in people’s minds. In this case, however, the questions answer themselves. Carl Richards in his book, ‘The Behaviour Gap’ has provided a framework of the ‘5 big money questions’ that simplifies the planning process till it’s just a matter of striking the right balance.

1. How much can you reasonably save?

Creating a savings corpus for the future doesn’t mean that present-day needs should be compromised upon. The ideal plan involves keeping a portion aside from one’s take-home salary after considering current lifestyle and spending habits. In this way, the future gets slowly secured while the present is lived to the fullest.

2. What is your rate of return?

Returns need to be looked at as something that will enable you to meet your financial goals. This along with the level of risk one is willing to take while investing is what dictates the rate of return one should chase. Having either an over or under-par risk profile can be detrimental to the final corpus created.

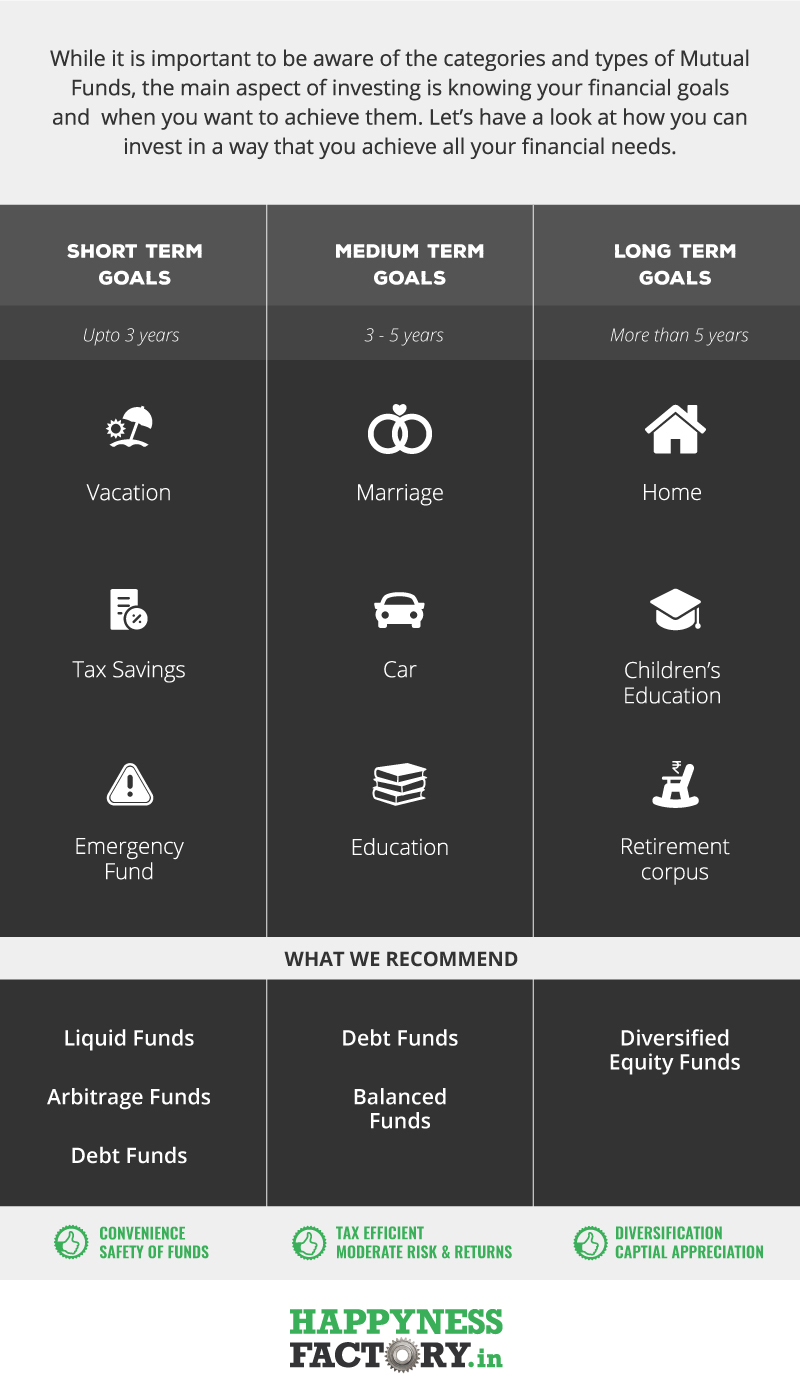

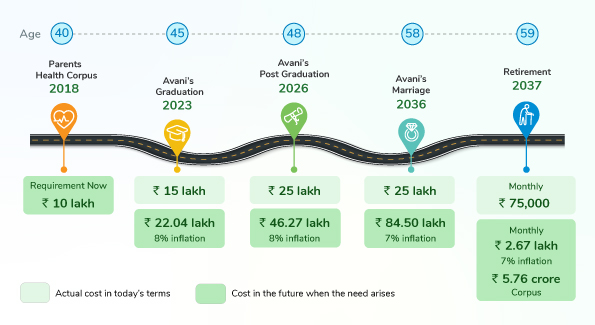

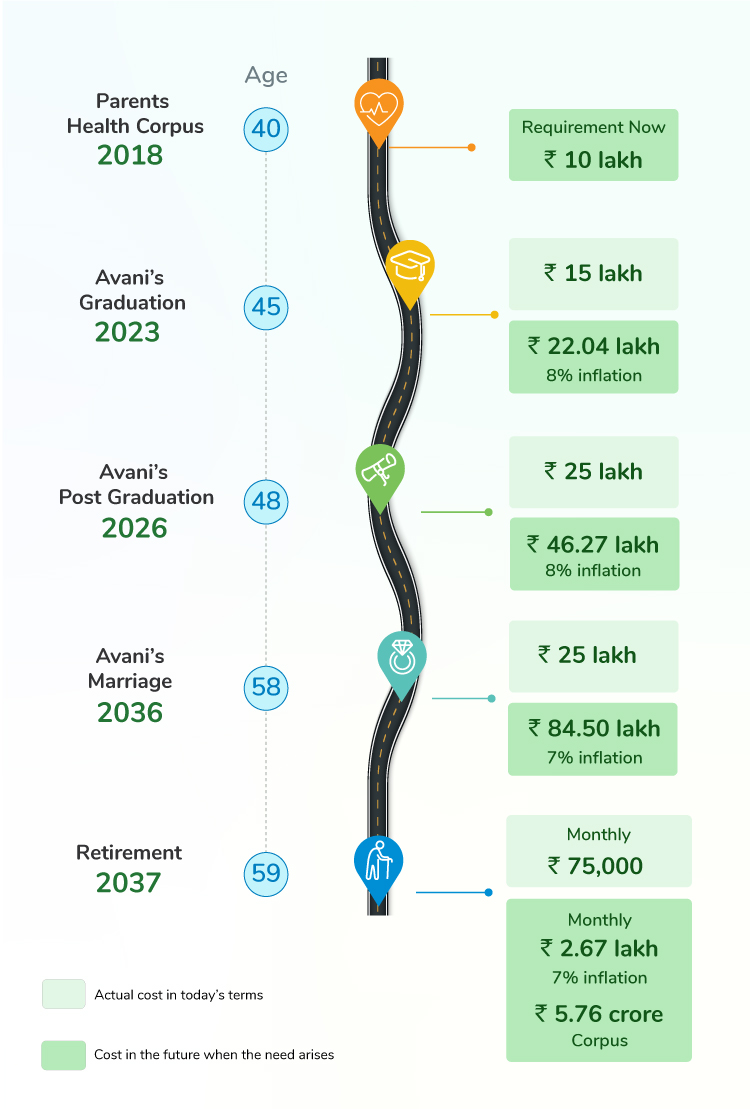

3. How much do you need?

Estimating the amount of money required in the future is very important. A thorough assessment of one’s current lifestyle and needs must be done, following which inflation must be considered. This ensures that one doesn’t fall short of money in the future or cramp up their lifestyle in the present.

4. When will you need the money?

Money can be needed at any time. As such, certain goals need to be set to make sure that you have enough funds to combat whatever need arises. This can be done by setting specific goals and a fixed end date. This way specific needs such as funds for education, home, and the car can be prepared for and emergencies too can be tackled with relative ease.

5. What do you want to leave?

For a lot of people, leaving behind a legacy that will be remembered fondly is very important. It’s like leaving one’s stamp on the future. And one of the best ways to do this is to ensure that your future generations are secure. By planning the right way, it is possible to lead a comfortable life in the present AND provide sufficient for future generations.

While only five questions might seem insufficient to build your entire financial future upon, they can be thought of as five separate choices that provide the necessary balance to your plan. There definitely are many more questions that can be asked but these basic questions are difficult enough to answer by themselves and they must be truthfully answered to get the best results.

The hallmark of planning this way is that the focus isn’t on investments and their rate of return. This works because the rate of return is only a small fraction of the investment equation. Several other factors like, “Can I make a trade-off if I don’t want to take the risk of investing in the stock market?” Or “Is it possible for me to save more or if not?”, “Can I retire a little later or think about pursuing a second career?” must be considered.

Building a financial portfolio cannot be the single-minded pursuit of the highest available returns. It requires forethought, frequent course corrections according to the demands of the situation, and more than anything else, an effort to maintain a healthy balance.